Navigating the Future: Insurance Solutions in 2024 Demystified

Navigating the Future: Insurance Solutions in 2024 Demystified

Blog Article

Why Insurance Is a Smart Financial Investment for Your Satisfaction

Insurance is frequently seen as an abstract investment, one that doesn't quickly supply the very same degree of enjoyment as buying a new automobile or investing in the stock market. It is specifically due to the fact that of this lack of instant satisfaction that insurance comes to be a wise financial investment for your tranquility of mind. Allow's discover the different types of insurance coverage plans, their benefits, and variables to think about when selecting insurance coverage, to understand just how insurance can really supply the tranquility we all seek in our lives.

Relevance of Insurance Policy Coverage

Insurance protection is a vital element of financial planning, providing essential defense and tranquility of mind against unforeseen occasions. Despite one's economic scenario, insurance policy protection is a wise financial investment that aids family members and individuals secure their possessions and protect their future. Whether it is medical insurance, life insurance policy, vehicle insurance policy, or residential or commercial property insurance coverage, having appropriate protection can ease the financial concern that comes with unpredicted circumstances.

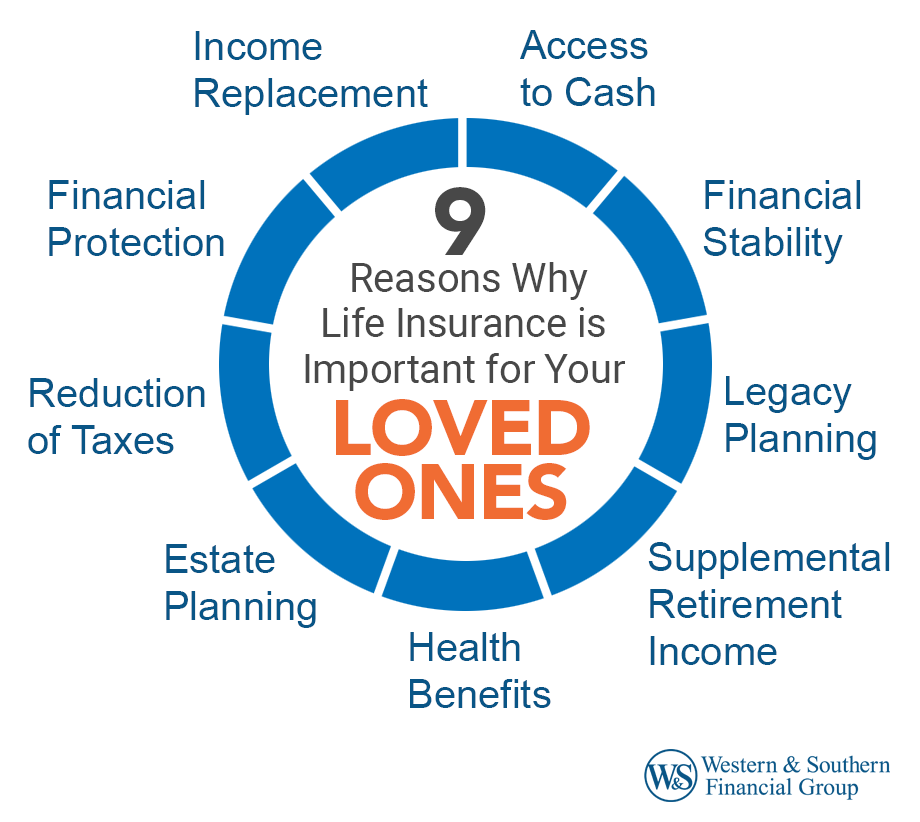

Among the key reasons insurance policy protection is crucial is its capacity to protect against monetary loss. Health and wellness insurance coverage makes sure that medical expenditures are covered, protecting against individuals from having to birth the complete impact of costly medical expenses. Similarly, life insurance policy offers financial backing to liked ones in case of the insurance policy holder's death, ensuring that their dependents are not left without the methods to sustain their high quality of life. Insurance Solution In 2024.

Insurance insurance coverage additionally supplies satisfaction. Recognizing that you are secured versus unexpected events can alleviate tension and stress and anxiety, permitting individuals to concentrate on other facets of their lives. It gives a feeling of security, knowing that if a crash, disease, or natural catastrophe were to take place, there is a safety and security web to fall back on.

Furthermore, insurance policy coverage promotes accountable economic planning. By having the essential protection, people can much better manage their finances and allot resources efficiently (Insurance Solution In 2024). It motivates people to think long-lasting and think about the possible risks they may encounter in the future, ensuring that they are sufficiently prepared

Sorts Of Insurance Plan

One typical type of insurance is life insurance policy, which offers a survivor benefit to the recipients in case of the insured's fatality. This kind of plan can assist provide monetary safety and security to loved ones and cover expenditures such as funeral expenses, arrearages, or income replacement.

Wellness insurance coverage is an additional important sort of insurance coverage that helps households and individuals handle medical costs. It can give coverage for physician brows through, hospital remains, prescription medications, and preventative care. Wellness insurance policies can be gotten via companies, federal government programs, or purchased separately.

Residential property insurance coverage is made to secure against damage or loss to physical possessions, such as vehicles, homes, or services. This kind of protection can aid people recover economically from events like fire, burglary, or natural disasters.

Other kinds of insurance coverage include auto insurance coverage, which covers damages or injuries resulting from car mishaps, and responsibility insurance policy, which shields people or services from legal insurance claims for physical injury or home damage.

Advantages of Spending in Insurance

Spending in insurance coverage gives individuals and households with very useful monetary security and peace of mind in the face of unpredicted occasions or losses. Insurance acts as a safety web, ensuring that individuals are financially secured when encountered with unforeseen conditions. One of the crucial benefits of investing in insurance is that it offers economic stability and safety and security throughout tough times.

Factors to Consider When Finding Insurance Policy

When picking an insurance coverage policy, it is critical to think about a variety of variables that align with your private needs and monetary situations. These aspects can help guarantee that you choose a policy that provides you with appropriate coverage and satisfies your details demands.

First of all, it is vital to evaluate the sort of insurance policy protection you need. This can include medical insurance, life insurance coverage, automobile insurance, or property owners insurance, among others. Each kind of insurance coverage offers various benefits and defense, so it is vital to figure out which ones are most relevant to your scenario.

Secondly, you should consider the price of the insurance coverage costs. It is necessary to review your spending plan and establish just how much you can easily afford to pay for insurance policy protection. Greater premiums might offer a lot more extensive insurance coverage, however they may also address strain your financial resources.

Last but not least, it is advisable to examine the terms of the insurance plan carefully. Comprehending the protection restrictions, deductibles, exemptions, and any additional benefits or motorcyclists will certainly assist you make an educated decision.

How Insurance Policy Supplies Assurance

Insurance coverage provides people the assurance and protection they need directory to navigate life's uncertainties with confidence. With the ideal insurance protection, individuals can discover tranquility of mind knowing that they are protected economically against these dangers.

Insurance offers tranquility of mind by using economic security in the face of adversity. Health insurance coverage guarantees that individuals receive needed medical care without the concern of excessively high medical expenses.

Moreover, insurance coverage provides assurance by providing defense for liked ones in the occasion of unpredicted conditions. Life insurance policy, for example, provides a financial safeguard for households in case of the insurance policy holder's fatality. This coverage assists to make certain that dependents can maintain their standard of life, repay financial obligations, or cover educational expenditures.

Insurance also offers tranquility of mind by offering lawful protection. Obligation insurance policy, such as specialist liability or basic liability insurance, shields people from economic losses and legal insurance claims resulting from accidents or negligence.

Conclusion

In verdict, buying insurance policy is a smart decision as it supplies people with important site peace of mind. Insurance policy coverage is vital for securing versus unanticipated occasions and prospective economic losses. By choosing the appropriate insurance plan and thinking about vital factors such as coverage limits and deductibles, individuals can safeguard themselves and their assets. Ultimately, insurance coverage offers a complacency and peace of mind, enabling people to confidently browse life's uncertainties.

Whether it is wellness insurance, life insurance policy, car insurance, or building insurance coverage, having appropriate protection can alleviate the economic concern that comes with unanticipated situations.

Wellness insurance policy guarantees that clinical costs are covered, avoiding people from having to bear the full impact of expensive clinical expenses.Having established the importance of insurance policy protection, it is currently crucial to check out the numerous kinds of insurance plans available to family members and people. This could include health and wellness insurance, life insurance policy, vehicle insurance, or home owners insurance policy, amongst others.

Report this page